How To Fly Business Class For Under $100

The flying experience means different things to different people. Economy flyers begrudgingly step foot on the plane, glowering at potential row-mates while they mentally prepare themselves for the battle of the next several hours. The light in the distance is the destination — the longer the flight, the further away the light.

Then there is business class. Being woken up to the landing protocol is met with disbelief as they ask themselves, how can it be over already? Being filled to the brim with champagne and lobster while completely rested from a fully flat bed will do that to you. The catch is, of course, cost. Any given business class flight will be several thousand dollars more than you or I are likely to spend.

The introduction of credit cards and airline miles, however, changed the game. Now low-cost opportunities to fly are completely attainable with some miles knowledge and a little financial aptitude — opportunities being recognized right now by tens of thousands of flyers.

Welcome to the travel hack of the generation: the world of credit card churning.

The Basics

Credit card churning is, quite simply, the practice of opening and closing credit cards repeatedly. This achieves two things: earn the bonus offer associated with opening an account and close the account before paying any fees.

But when I mention the topic, 99% of people immediately are on the defense. And listen, I get it. Having multiple credit cards goes against everything you’ve ever heard from a personal finance perspective. Even I, after working in payments and with credit scores for several years, pushed back initially.

Hear me out though. I have already written in depth about the misconception that multiple credit cards mean a lower credit score. To be blunt: that statement just isn’t true.

After applying for over fifteen credit cards a year for four years, my credit score improved (and I’ve only kept a handful open). This is done with careful management of your finances and a sound understanding of the factors that influence your score. Don’t just take it from me. Tens of thousands of others do it the same with similar — or much, much better — results.

Who Is Eligible?

Now, the most important part: who is eligible to do this, and why? Quite frankly, anyone can apply the principles of credit card churning for their own benefit — meaning optimizing their credit score to receive a higher return on the dollars they spend.

In my experience, though, the ones that go the furthest with this hobby have an entrepreneurial spirit and ability to take risks. While I’ve been approved for over 60 credit cards, I’ve also been declined for a handful. That is never fun (although the impact is small and reversible with time). Plus, starting out is largely a leap of faith that research — like reading this article — is sound.

Also of the highest importance is an ability to manage finances and avoid debt. I can’t stress this enough: any amount of debt that you aren’t able to pay off is not worth any amount of airline miles. Since the people with the highest returns have 20+ credit cards open at any given time, I only advise this to people who can adequately organize and manage that many bank credentials, card details, etc . . .

Finally: Business Class!

If you’ve read this far, I commend you for having an open mind. Learning the credit card churning trade was the single biggest moment in my travel life. Since then, I have traveled to dozens of countries, flown $10,000 flights and stayed in villas I would have never dreamed of paying for, which is a long way of saying: keep reading.

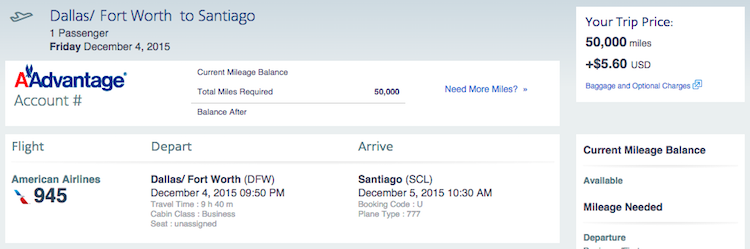

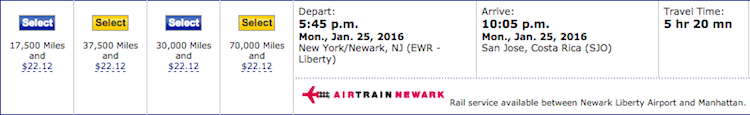

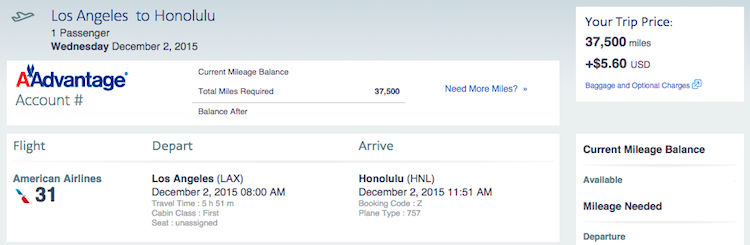

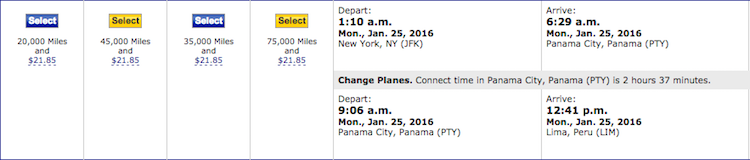

Below these paragraphs are screen shots of business class award flights. This is an extremely small sample size of the possibilities of credit card churning, mainly in South America (for no other reason than I am currently planning business class trips there).

What I like about the below is that one credit card bonus would give you enough award miles to book a one-way ticket in business class (or round-trip in economy). Meaning you could book this, right now, for under $100 and a little time.

Results

Again, the above is a very small sample size and meant to illustrate how far one card can get you, even in business class. But 5, 10, or 15+ cards later – especially when your credit score is improving – the idea is to combine credit cards and unlock round-trip business class flights to any corner of the earth.

In the four years I have been doing this, I have an average return of 15% on the dollars I spend – about half of which has gone to luxury travel. Seeing the above examples, you can quickly see how I pieced together two card applications to net a business class flight worth thousands of dollars. Assuming I spent $6,000 – the average for two credit cards – to receive the bonus miles, a $6,000 flight would be a 100% return. That isn’t too shabby.

Now Start

Okay, that is a lot of information in one sitting. I don’t mean to make this sound too easy. Managing all the cards, application times and different bank criteria can be a headache at times. And because the banks, airlines and hotels are constantly changing bonus offers, eligibility criteria and more, someone getting started can quickly get overwhelmed.

As someone who recently started as well, I suggest keeping things simple: read as much as possible on the subject, whether on my website or others. Then, when you feel like you understand the game, apply for a card or two, and wait. Watch your credit score, monitor your spending and make sure you can handle the uncertainty.

The worst case scenarios is that you decide against credit card churning, cancel your cards and the very minimal impact (likely 4 to 6 points) to your credit score will be gone within two years. Best case scenario is that you enjoy the hobby, find a rhythm in your spending and enable trips-of-a-lifetime multiple times a year. It’s your choice.

/

Kyle Zuvella is a travel writer currently on a 30-country trip around the world, using 2,000,000 airline miles and hotel points. For more of his work, visit MrFreeMiles.com.

Kyle Zuvella is a travel writer currently on a 30-country trip around the world, using 2,000,000 airline miles and hotel points. For more of his work, visit MrFreeMiles.com.